It certainly has been an interesting few weeks, especially in the political arena. One situation I thought I would bring up is the White House has now been shut for visitors to tour. The decision was made in an effort to cut costs by the federal government. Our country is now going to deny little kids and tourists the right to tour the White House because its own spending discipline has been so lax. The trivial nature of this decision strikes at the heart of why people find our government so, shall we say, questionable. Our government does nothing about the serious problems of entitlement spending, waste in the military, and plenty of other spending travesties (GSA Scandal, Fast and Furious, etc), but closing the White House for tourists is going to help solve the problem of wasteful spending. If I remember correctly, Mitt Romney was demonized for bringing up Big Bird and PBS. Let's also point out the taxpayers pay for the White House, so the idea it should be closed for tourists is really a poor decision.

Next, lets certainly mention the speech Mr. Obama gave in Chicago outlining his plans to create a $2 billion dollar trust fund to research and develop alternatives to fossil fuels-http://www.technologyreview.com/view/512571/obama-stumps-for-energy-research-through-trust-fund/

If you are involved in business in any industry, you have to really give some hard thought to what Obama is proposing. What he wants to do is use the government licensing and permitting revenue sources on the energy industry to fund research to reduce the dependence on oil and gas in the United States. If I am an oil or gas industry executive, you would have to shake your head and think, "I'm not going for that." Any industry could be vulnerable to a government which would tax the businesses in an industry in order to create a situation where those businesses lose customers. Why would any company want that? Alternative energy is trying to become more cost competitive to fossil fuels, and private businesses are going to make a huge effort to do so because there is potentially a great deal of profit available. However, the idea of taking off shore permits and licenses as a way to fund government research to do so strikes me as vindictive at worst, petty at best. In addition, realistically, it wouldn't happen for another 50 years, even in the most optimistic of scenarios. Good luck with that one Obama, your going to need it.

Another situation our president is involved in is the Keystone pipeline decision, which should take place by the end of the year. I would wager he will decide against approving the pipeline. The group who will lose the most from the decision will be the citizens in North America, mainly U.S. and Canadians. The bottlenecks which are taking place in the energy industry can only be relieved by transportation methods to move feedstock of oil to refineries, many which are located in logistically ideal areas near transportation hubs. Typically, they are in coastal areas, the west coast, gulf coast, and east coast. Canada badly needs transportation to move fuel, and one way or another, they are going to build these methods at some point. Ultimately, it may be that Asian countries will benefit from these efforts, as opposed to the U.S.

Finally, on the political front, the Iran situation with nuclear weapons and Israel is continuing to move to the front stage. Iran has been dramatically weakened by financial sanctions, a devaluation of their own currency, and the loss of strength in Syria. Still, when you consider the statements made by their leaders about wiping Israel off the map, the seriousness of Iran is not at all a small issue. Israel is not going to stand by and be at the mercy of radical leaders. If Obama will not stand by a military strike by Israel, and he has no history of showing the will do do so, Israel will go it alone. As they should. http://worldnews.nbcnews.com/_news/2013/03/17/17306968-on-the-brink-israel-to-grill-obama-over-possible-military-strike-on-iran?lite&ocid=msnhp&pos=

The stock market went up 10 days in a row as investors certainly are more inclined to give equities the benefit of the doubt. However, what took place in Cyprus over the weekend is probably going to have some implications about how people continue to view the banking system, especially in Europe. The world is incredibly interconnected, and with information available so quickly, events move markets in a very rapid manner. The volatile nature of markets only becomes more pronounced when anyone can find out everything they want to know about almost any subject. It does not mean you cannot find situations which offer great value. In fact, in most markets volatility becomes an investors best friend as it can help create great prices for very valuable assets. The important questions are can you find these situations, what price are you willing to pay for them, do you have the nerve and judgement to buy them, and do you have the patience and stomach to hold them if the market continues to price them in a way you don't necessarily agree with? These are the key issues which make investing interesting, and potentially difficult, or rewarding.

I find it very interesting that the guys who are essentially the creators of the efficient market hypothesis seek to profit from market inefficiencieshttp://www.nytimes.com/2013/03/17/your-money/david-booth-of-dfa-using-the-chicago-schools-theory.html?ref=business&_r=0

If you are involved in business, reinvesting in the business in a productive way is a key to creating growth-http://www3.cfo.com/article/2013/3/cash-flow_growth-investments-performance-scorecards-reinvestment-rate

Are venture capitalists going to be threatened by crowd funding? Definitely an intriguing possibility-http://techcrunch.com/2013/03/17/is-software-eating-the-venture-capitalists-too-part-i/

Thank you for reading the blog this week, and I hope you are enjoying the spring weather, wherever you may be.

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Sunday, March 17, 2013

Saturday, March 9, 2013

Traveling, Turnarounds, Gross's 'New Normal', and March Madness

I can recall when I was a kid, I used to really enjoy traveling by plane. The excitement of a new destination and going on a plane was really a joy for me. My family and I decided to make a long trip to Johannesburg, South Africa to attend a family function. The length of the excursion, over 24 hours each way, made it challenging. The stopover was in London after about a 10 hour first segment. The same process took place on the way back, except the layover in London was nine hours.

My feelings about airline transit are now completely reversed as I think there is not a worse user experience. First, people's time is not really considered by government authorities as you have to spend hour upon hour waiting in lines to have a full body cavity search. Next, many airports are not equipped with wireless internet access, making every landing spot a treasure hunt to find places with wireless capability. If you are a tall person and you are not traveling business class, you are in a flying sardine can where your knees are in your chest for 98% of your trip. The planes are also typically full of coughing and sneezing passengers, making sickness prevention a priority. Many of the airlines customer service representatives do a superb job of trying to help customers and their hard work goes overlooked far too often. Notice I never mentioned the new pricing methodologies the airlines have implemented for baggage and other items. I understand airlines need new methods to raise revenue in order to become more profitable. Indeed, if ever an industry had to think out of the box on finding additional revenue sources, it was the airlines. However, I think for myself, and for most people, traveling has become something I will try to avoid at all costs. If the destination is not far, it may be different, but I still think the user experience leaves plenty to be desired.

J.C. Penny's is right in the middle of a legal fight with Macy's over the exclusivity of the Martha Stewart brand. (http://www.nytimes.com/2013/03/09/business/the-headache-in-housewares-for-j-c-penney.html?ref=business&_r=0) In addition to this legal drama, Penny's performance in 2012 was terrible, and the CEO is now being questioned all about the viability of the turnaround strategy. If ever there was an example of why turnaround's are very difficult investment propositions, this would be it. It also explains why Warren Buffett makes sure to avoid turnaround's at all costs.

Pimco's Bill Gross came out with the term the 'New Normal' as a way to describe the revision downward of economic growth in mature countries like the United States. Gross and Pimco's Mohamed El- Erian have repeatedly pounded the drum of slowing economies over the last few years. On Friday, the United States came out with a job report which showed the number of jobs being created far exceeding analyst estimates. In fact, most of the job gains came from the private sector, with government actually losing positions. Guess what? Mr. Gross now raised his estimate for U.S. economic growth to 3% for the year. (http://www.bloomberg.com/news/2013-03-08/gross-raises-u-s-economic-growth-forecast-to-3-in-2013.html) Like a rainbow follows after a downpour, the 10 year bond yield jumped dramatically over 2% as the market suspects growth will start to accelerate. It may yet be premature, but the consistent speculation about a secular move from bonds to stocks is very much front and center in the financial markets and money management profession.

March madness is upon us as the annual rite of passage known as the NCAA basketball Tournament will start in a few weeks. I was recently reading a little bit of Bobby Knight's recent book, titled Negative Motivation or something close to it. One of the premises of the book is victory usually goes to teams which make the fewest mistakes. Investing is very similar in many respects as there are many mistakes which can impede a an investor's financial progress. Firms use the term 'risk management' to have policies in place to mitigate the potential problems of investing or operations in a business. However, many mistakes in investing come from errors of omission as Charlie Munger calls it, 'The Sucking One's Thumb' syndrome. If an investor does not allocate capital to a great opportunity when they are present, and admittedly, there are very few great investment possibilities, the inability to capitalize can be tremendously costly. Evaluating risk management without considering the opportunity cost of doing nothing is not accurate either.

James Altucher is always an entertaining read (know there is a bit of profanity in the blog)-http://techcrunch.com/2013/03/09/how-to-make-a-million-dollars-with-a-hot-dog-cart/

CFO magazine is typically informative, in this case about cash usage and the lingering issues in Europe with respect to financing for businesses:

http://www3.cfo.com/article/2013/3/cash-flow_toll-brothers-revenue-cash-economic-recession?mid=152102&rid=152102.68300.17080

http://www3.cfo.com/article/2013/3/credit_ecb-southern-europe-credit-crunch-lending-commercial-loan-italy-portugal-spain-

Spring is right around the corner, and I am sure many people are looking forward to the nice weather. I hope all readers have a great weekend and week. Thank you as always for reading the blog and if you have any comments, please feel free to post them!

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

My feelings about airline transit are now completely reversed as I think there is not a worse user experience. First, people's time is not really considered by government authorities as you have to spend hour upon hour waiting in lines to have a full body cavity search. Next, many airports are not equipped with wireless internet access, making every landing spot a treasure hunt to find places with wireless capability. If you are a tall person and you are not traveling business class, you are in a flying sardine can where your knees are in your chest for 98% of your trip. The planes are also typically full of coughing and sneezing passengers, making sickness prevention a priority. Many of the airlines customer service representatives do a superb job of trying to help customers and their hard work goes overlooked far too often. Notice I never mentioned the new pricing methodologies the airlines have implemented for baggage and other items. I understand airlines need new methods to raise revenue in order to become more profitable. Indeed, if ever an industry had to think out of the box on finding additional revenue sources, it was the airlines. However, I think for myself, and for most people, traveling has become something I will try to avoid at all costs. If the destination is not far, it may be different, but I still think the user experience leaves plenty to be desired.

J.C. Penny's is right in the middle of a legal fight with Macy's over the exclusivity of the Martha Stewart brand. (http://www.nytimes.com/2013/03/09/business/the-headache-in-housewares-for-j-c-penney.html?ref=business&_r=0) In addition to this legal drama, Penny's performance in 2012 was terrible, and the CEO is now being questioned all about the viability of the turnaround strategy. If ever there was an example of why turnaround's are very difficult investment propositions, this would be it. It also explains why Warren Buffett makes sure to avoid turnaround's at all costs.

Pimco's Bill Gross came out with the term the 'New Normal' as a way to describe the revision downward of economic growth in mature countries like the United States. Gross and Pimco's Mohamed El- Erian have repeatedly pounded the drum of slowing economies over the last few years. On Friday, the United States came out with a job report which showed the number of jobs being created far exceeding analyst estimates. In fact, most of the job gains came from the private sector, with government actually losing positions. Guess what? Mr. Gross now raised his estimate for U.S. economic growth to 3% for the year. (http://www.bloomberg.com/news/2013-03-08/gross-raises-u-s-economic-growth-forecast-to-3-in-2013.html) Like a rainbow follows after a downpour, the 10 year bond yield jumped dramatically over 2% as the market suspects growth will start to accelerate. It may yet be premature, but the consistent speculation about a secular move from bonds to stocks is very much front and center in the financial markets and money management profession.

March madness is upon us as the annual rite of passage known as the NCAA basketball Tournament will start in a few weeks. I was recently reading a little bit of Bobby Knight's recent book, titled Negative Motivation or something close to it. One of the premises of the book is victory usually goes to teams which make the fewest mistakes. Investing is very similar in many respects as there are many mistakes which can impede a an investor's financial progress. Firms use the term 'risk management' to have policies in place to mitigate the potential problems of investing or operations in a business. However, many mistakes in investing come from errors of omission as Charlie Munger calls it, 'The Sucking One's Thumb' syndrome. If an investor does not allocate capital to a great opportunity when they are present, and admittedly, there are very few great investment possibilities, the inability to capitalize can be tremendously costly. Evaluating risk management without considering the opportunity cost of doing nothing is not accurate either.

James Altucher is always an entertaining read (know there is a bit of profanity in the blog)-http://techcrunch.com/2013/03/09/how-to-make-a-million-dollars-with-a-hot-dog-cart/

CFO magazine is typically informative, in this case about cash usage and the lingering issues in Europe with respect to financing for businesses:

http://www3.cfo.com/article/2013/3/cash-flow_toll-brothers-revenue-cash-economic-recession?mid=152102&rid=152102.68300.17080

http://www3.cfo.com/article/2013/3/credit_ecb-southern-europe-credit-crunch-lending-commercial-loan-italy-portugal-spain-

Spring is right around the corner, and I am sure many people are looking forward to the nice weather. I hope all readers have a great weekend and week. Thank you as always for reading the blog and if you have any comments, please feel free to post them!

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Sunday, February 17, 2013

Animal Spirits, Favoring Facebook, Tesla, and More-

With Berkshire Hathaway's acquisition of Heinz, the deal making environment looks like it is starting to do more than bubble up. Over the last month, Liberty Global has purchased Virgin Media, Oracle bought Acme Packet, and Dell is looking to take itself private. The current environment has interest rates at rock bottom so financing is incredibly cheap. Public companies have record levels of cash on their balance sheets, and investors are starting to put pressure on management teams to either return the capital or do something productive with it. From the perspective of a shareholder or investor, if a company is sitting on high cash levels and earning nothing on it, you have an unproductive asset. If the cash is held for long periods of time, investor's also lose because of the missed opportunity of using the cash on other potentially more productive assets. If you combine these factors with the fact that many large companies also have very productive cash generating businesses which can be used to pay off potential loans, if this is not a great situation for deal making, when would it be? Moreover, management groups also have a fiduciary responsibility to shareholders to try to increase shareholder value. One way is by purchasing other enterprises which can help their existing businesses. It could very well be we see a lot more activity in the merger and acquisition front over the next year.

Facebook has built a large business and could see many years of growth in front of it. It currently has about $10 billion dollars of cash on the balance sheet, and no debt. It currently made public it will probably pay zero tax to the federal government in 2012. Our president publicly has stated the government should look at closing loopholes many big businesses use to avoid paying their tax obligations. Not only that, specific industries, especially energy, are chastised because they receive tax breaks when they are clearly large and profitable and don't need that preferred status. I think if you are going to be considered even-handed, the government should refrain from criticizing one industry for using tax laws to their advantage, and then ignore others, like those in high-tech, for doing exactly the same thing.

I don't know how many of you have been paying attention to the Tesla Motor controversy with the NY Times. If you have not, it is pretty straightforward. A reporter from the NY Times who owned a Tesla automobile tried to go on a 200 mile trip on the east coast during cold weather. The vehicle he owns was bought for the bargain price of $100,000. The story documented many problems the reporter had during the trip as the car had to stop numerous times. Tesla now says the story was fake and the two organizations are trading barbs through the media. Many in the press have written about how wonderful these electric cars are from Tesla. I have read some investors opinions on how they believe Tesla is a transformational type company. The practical aspect of the idea of electric cars as a mainstream alternative looks more and more questionable, to say the least. People are not going to pay elevated prices for a car which is not close to being functional at all times and in all-weather types. You could also take this a step further and very much question the idea of alternative energy sources being a practical alternative to traditional carbon based solutions. You better believe you will see more and more questions about this issue in the months ahead.

Here is a nice summary of the merger and acquisition situationhttp://www.cnbc.com/id/100461022

If you want more details about the Facebook tax controversy, maybe take a look

http://www.businessweek.com/articles/2013-02-15/facebook-gets-a-multi-billion-dollar-tax-break#r=rss

Native applications are all the rage- here is an analysis of the emerging industry-http://techcrunch.com/2013/02/17/the-native-ad-movement-and-the-opportunity-for-web-publishers/

Gold and silver prices had a very tough week, but I wouldn't count them out- here is one writer's thought-

http://seekingalpha.com/article/1199661-it-s-gut-check-time-for-gold-and-silver

I hope all of you are having a great weekend and thank you for reading the blog.

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Facebook has built a large business and could see many years of growth in front of it. It currently has about $10 billion dollars of cash on the balance sheet, and no debt. It currently made public it will probably pay zero tax to the federal government in 2012. Our president publicly has stated the government should look at closing loopholes many big businesses use to avoid paying their tax obligations. Not only that, specific industries, especially energy, are chastised because they receive tax breaks when they are clearly large and profitable and don't need that preferred status. I think if you are going to be considered even-handed, the government should refrain from criticizing one industry for using tax laws to their advantage, and then ignore others, like those in high-tech, for doing exactly the same thing.

I don't know how many of you have been paying attention to the Tesla Motor controversy with the NY Times. If you have not, it is pretty straightforward. A reporter from the NY Times who owned a Tesla automobile tried to go on a 200 mile trip on the east coast during cold weather. The vehicle he owns was bought for the bargain price of $100,000. The story documented many problems the reporter had during the trip as the car had to stop numerous times. Tesla now says the story was fake and the two organizations are trading barbs through the media. Many in the press have written about how wonderful these electric cars are from Tesla. I have read some investors opinions on how they believe Tesla is a transformational type company. The practical aspect of the idea of electric cars as a mainstream alternative looks more and more questionable, to say the least. People are not going to pay elevated prices for a car which is not close to being functional at all times and in all-weather types. You could also take this a step further and very much question the idea of alternative energy sources being a practical alternative to traditional carbon based solutions. You better believe you will see more and more questions about this issue in the months ahead.

Here is a nice summary of the merger and acquisition situationhttp://www.cnbc.com/id/100461022

If you want more details about the Facebook tax controversy, maybe take a look

http://www.businessweek.com/articles/2013-02-15/facebook-gets-a-multi-billion-dollar-tax-break#r=rss

Native applications are all the rage- here is an analysis of the emerging industry-http://techcrunch.com/2013/02/17/the-native-ad-movement-and-the-opportunity-for-web-publishers/

Gold and silver prices had a very tough week, but I wouldn't count them out- here is one writer's thought-

http://seekingalpha.com/article/1199661-it-s-gut-check-time-for-gold-and-silver

I hope all of you are having a great weekend and thank you for reading the blog.

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Friday, February 8, 2013

TINA, Technology, and Justice-

It is starting to get a whole lot more interesting in the capital markets. You see, the talk of a great migration out of bonds and into stocks is starting to get institutions and some retail investors a bit nervous, or excited, depending on your positions. One of the web sites I started reading is thereformedbroker.com, written by ex-broker Josh Brown. In one of his daily links, a trader came up with the acronym which I think is very appropriate TINA. What does TINA refer to? TINA speaks to the asset allocation decision many investors have to now grapple with of staying in cash, bonds, or cd's and getting potentially beat up by inflation or rising interest rates, or moving a greater percentage of capital to stocks? As the 10-year treasury bond yield hovers above or close to 2%, more and more investors are starting to believe in the TINA answer: There Is No Alternative! With the global and U.S. economy potentially starting to accelerate, the question will become more and more important, especially if the expansion has arrived.

I don't think there has ever been a time for investors when technology is potentially so disrupting to established companies, and even entire industries. If you look at specific industries which might be vulnerable, certainly retail is one because of the fixed costs of rent, inventory, overhead, etc. My own opinion is a couple of others which are just as exposed would be education and government. Can you think of two other industries which operate so inefficiently and are ripe for a more effective approach? If you look at startup companies, many are focused on education, but very few related to government.

The Federal Government decided to sue Standard and Poor's for its role in rating mortgage and asset backed securities during the housing boom and bust. It is very possible they will also go after Moody's as well. The first investor who mentioned these issues was David Einhorn, of Greenlight Capital, a few years ago. Both of these stocks have fallen hard over the last week. What many people don't understand about the stock market is often times, it takes a long time for events to play out. It does not mean they will never unfold, just it takes time.

Bringing up the topic of time and the U.S. government, if the ratings agencies are fair game, what about CEO's like Jimmy Cayne of Bear Stearn's, Dick Fuld of Lehman Brothers, and Stan O' Neal of Merrill Lynch? Even five years later, These guys nearly brought down the entire financial system but not one charge has been brought against them? Justice and the sands of time....

Speaking of David Einhorn, he spoke out yesterday about the capital allocation policies of Apple by suing them because they wanted to eliminate the threat of issuing preferred stock. Capital allocation is a massive issue for companies as it gets to the heart of how they balance shareholder value and the pursuit of profitable growth. Using debt, internally generated cash, or issuing equity are all possibilities, but the art of knowing when to use the appropriate tool(s) is critical for the management of any public company.

A nice article by LinkedIn Founder Reid Hoffman about the threat to retail-

http://www.linkedin.com/today/post/article/20130208012431-1213-will-software-eliminate-physical-retail-not-quite

Google has been implementing changes to its advertising program-http://bits.blogs.nytimes.com/2013/02/08/google-changes-its-ad-program-to-try-to-solve-the-mobile-ad-riddle/?ref=business

Warren Buffett's son Howard says he is ready to take the job as if anybody could fill the man's shoes-http://www.bloomberg.com/news/2013-02-08/buffett-s-son-says-he-s-prepared-whole-life-for-berkshire-role.html

If you really don't like bankers-http://www.marketwatch.com/story/so-god-made-a-banker-2013-02-06

Thank you for reading, and I hope you have a great weekend and are happy and healthy.

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

I don't think there has ever been a time for investors when technology is potentially so disrupting to established companies, and even entire industries. If you look at specific industries which might be vulnerable, certainly retail is one because of the fixed costs of rent, inventory, overhead, etc. My own opinion is a couple of others which are just as exposed would be education and government. Can you think of two other industries which operate so inefficiently and are ripe for a more effective approach? If you look at startup companies, many are focused on education, but very few related to government.

The Federal Government decided to sue Standard and Poor's for its role in rating mortgage and asset backed securities during the housing boom and bust. It is very possible they will also go after Moody's as well. The first investor who mentioned these issues was David Einhorn, of Greenlight Capital, a few years ago. Both of these stocks have fallen hard over the last week. What many people don't understand about the stock market is often times, it takes a long time for events to play out. It does not mean they will never unfold, just it takes time.

Bringing up the topic of time and the U.S. government, if the ratings agencies are fair game, what about CEO's like Jimmy Cayne of Bear Stearn's, Dick Fuld of Lehman Brothers, and Stan O' Neal of Merrill Lynch? Even five years later, These guys nearly brought down the entire financial system but not one charge has been brought against them? Justice and the sands of time....

Speaking of David Einhorn, he spoke out yesterday about the capital allocation policies of Apple by suing them because they wanted to eliminate the threat of issuing preferred stock. Capital allocation is a massive issue for companies as it gets to the heart of how they balance shareholder value and the pursuit of profitable growth. Using debt, internally generated cash, or issuing equity are all possibilities, but the art of knowing when to use the appropriate tool(s) is critical for the management of any public company.

A nice article by LinkedIn Founder Reid Hoffman about the threat to retail-

http://www.linkedin.com/today/post/article/20130208012431-1213-will-software-eliminate-physical-retail-not-quite

Google has been implementing changes to its advertising program-http://bits.blogs.nytimes.com/2013/02/08/google-changes-its-ad-program-to-try-to-solve-the-mobile-ad-riddle/?ref=business

Warren Buffett's son Howard says he is ready to take the job as if anybody could fill the man's shoes-http://www.bloomberg.com/news/2013-02-08/buffett-s-son-says-he-s-prepared-whole-life-for-berkshire-role.html

If you really don't like bankers-http://www.marketwatch.com/story/so-god-made-a-banker-2013-02-06

Thank you for reading, and I hope you have a great weekend and are happy and healthy.

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Saturday, January 26, 2013

The Market Bites Apple, Why It Is Ok to Try and Beat the Market, and Icahn vs Ackman-

We had a very interesting week in the capital markets as the big elephant in the room is clearly the poor stock performance of Apple. The stock is down nearly 40% from its high and the jump the ship analysts are running for the hills. Exxon-Mobile regained the title has the most valuable company in the world. Many investors are questioning whether Apple is the next Microsoft because the market value is so big (almost $500 billion) it will be hard for the stock to perform well. These kinds of questions are at the very heart of investing capital and require rational thinking.

You have to look at the past and the future and try to evaluate what is the most probable outcome. Will Apple's dominance suddenly be relinquished in the smart phone and tablet market? Is Samsung going to own the low end market in the emerging markets of China and India without competing products from Apple? Does Apple have the ability to create new and more innovative products which will capture the imagination of consumers on a global basis? Are there potential acquisitions Apple can make which can address product areas which are holes in their portfolio? Right now, the world is ending and the company is seen as a broken growth company. However, they just sold 50 million devices in three months and they have a cash hoard of nearly $150 billion. I should also point out if you have own one Apple in your lifetime you are very fortunate. It will probably be impossible for them to duplicate the kind of stock performance they had last 15 years. People are going to make up their minds one way or another, and it is really will be fascinating to watch how it plays out over the next one, three, and five years.

When people ask me what they should invest in now, I always like to start out by asking them what do they have expertise in? The reason why I ask that is because any time you have a knowledge advantage in specific business areas, you have an opportunity to benefit from your special background or training. Over the last few months, there were a few companies in a specific area of the market which I have a great deal of experience in. In fact, I am very confident no matter how many analysts there are on Wall Street, I am just as familiar with these industries and specific companies as they are. Consequently, when a few businesses were offered at attractive prices, or at least what I thought were good value, we spent our capital. The greatness of Warren Buffett is he emphasizes thinking for yourself and making decisions based on evaluating businesses. Many people who invest adopt the strategy of buying the same companies as other well known investors. If you are really a true practitioner of value investing using Buffett

type strategies, you find your own investments which offer compelling value. So an important point to consider is why even bother trying to beat the market?

The answer is actually very simple. When you look at investment results over a long period of time, lets say 5 years or more, the rewards an investor gets from doing better than a market index like the Dow, S&P 500, or Nasdaq by even 1% per year are incredibly large. There is a statistic from one of Buffett's annual shareholder letters which says that over 65 years, if you invested 10K and got the S&P return, your total market value would be around 950K. If you had beat the market by 10% a year, your market value would be around 95 million. So each percentage point per year is worth 9 million bucks of increased net worth. Many people say buy indexes and be happy with the market return, and in a lot of situations this is sound thinking. However, because the benefits of good performance are so large, if you can even do a little better than the market, I think the effort is certainly worth making (if you want the exact numbers I can send you the passage- just email me at information@y-hc.com)

One of the more fascinating events on Wall Street this week was the confrontation which took place on CNBC between two legendary investors, Carl Icahn and Bill Ackman. If you want to see what happened, you can watch it here-http://www.cnbc.com/id/100408608. I would just say both are great investors, and each uses their own methods very successfully. They have a long history together, and there is plenty of animosity in their relationship. If you add the Herbalife short position which Ackman is involved in, the potential for conflict is genuine and it could only get worse. The Herbalife short position is another great story which most investors will be following over the next year. The Super Bowl has nothing on the conflict between Ackman and Icahn. Personally, I think ultimately Ackman will be proved correct.

Apple is revising the way it forecasts earnings-http://go.bloomberg.com/tech-blog/2013-01-23-apple-conservative-forecast/

Retailers are making large inroads in attracting customers to their apps-http://techcrunch.com/2013/01/25/mobile-shopping-apps/

Every time I read CFO.com I get valuable insight. If you are a business person, I cannot recommend it highly enough-

http://www3.cfo.com/article/2013/1/forecasting_cash-horde-crowdfunding-big-data-obamacare-small-to-medium-sized-business-revenue-recognition-lease-accounting

Thank you for reading, and I hope you have a great weekend and are happy and healthy.

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Saturday, January 19, 2013

Earnings Season, Energy, and Startups-

It has been a while, so please indulge me as I bring to the table a nice assortment of topics. First, let's consider what is happening in the capital markets, specifically the stock market. Earnings season is upon us, and the large money center and investment banks generally have reported results which are reflective of their specific situations. The same cast of characters give us the same roles in the same movies. Should we be surprised? No, of course not.

The one area which was interesting was in the investment banking world where Morgan Stanley indicated they are looking forward to concentrating on growth. With the improvement in the housing industry, one would think the large banks focused on consumer credit, mortgage underwriting, and commercial lending would stand to prosper. Shareholders in these companies would certainly welcome better performance as the stocks have been so bad for so long any kind of return to normalized earnings power would boost the entire sector. In fact, they were so beaten down that in 2012 financials were the best performing industry in the stock market.

I just had to bring up the fact that Berkshire Hathaway is rebounding strongly and has had a big move recently. Just to show you how well Mr. Buffett has positioned Berkshire, their ownership of the Burlington Northern railroad was a great investment. Burlington now carries approximately 35% of all the oil in North America which is not moved by pipeline. With a five year backlog on railroad cars, profitability for Burlington is guaranteed for as far as the eye can see. Equity markets reward profits, and about 6 months or a year ago Berkshire's stock was languishing and the critics of Buffett were out in full force. If the energy boom is even remotely as strong as many suggest, it will be a long time before Berkshire Hathaway's stock performs poorly.

I found it interesting that Dell is now discussing a transaction which might take the company private. In the same domain, Hewlett-Packard decided to pay Meg Whitman 14 million dollars for her work last year. My own opinion is the boards of both companies are making big mistakes with these decisions. Dell faces challenges but to go private with a small premium in the hopes of coming back to the public markets in a few years is stupid. As for the board of the largest computer company in the world, maybe they think Meg has stabilized the situation. Still, if you take into consideration the mood of the public for entities like banks which pay executives big compensation packages for poor performance, it is hard to see how this is any different. With the stock at decade lows and questions about how HPQ will compete in tablets and smartphones, as well as being a second tier competitor in enterprise consulting, it would be smart of Mrs. Whitman to reconsider accepting the pay package.

The events in Algeria again point out the importance of energy in the global marketplace. It even further underscores the increased demand of large multi national corporations for security information and services. During this week I read a report on energy trends by a large oil company. The report mentioned the increase in fuel standards (by yes, the Obama Administration) as helping improve efficiency. A few key points were straightforward:

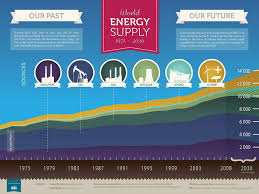

First, there is a massive shift occurring because of the improved capability of producing oil and gas in North America. In 2012, North America produced more energy related resources than ever before, up by about 15% over 2011. Second, emerging countries in Asia are where the vast majority of demand growth in energy will take place. Countries like China and India are going to be dependant on the rest of the world for energy supplies. As much as I hate to admit it, Russia is in a very strong position with respect to energy. The issue there is how effective their companies can be in getting the resources out of ground and to the market. Just as pertinent, the sources of energy production are going to be pretty stable for a long time. Even though the current administration loves to talk about alternative energy investment, the facts indicate materials like oil, natural gas, and coal will remain dominant for a long time. A great deal of the growth in supply will come from alternative energy areas like solar, wind, and nuclear, but they only make up about 7% of total inputs. With energy, the time frames to be considered are decades, not months or years.

Recently, I have been looking into the investment merit of startup companies. My rationale for doing so is the current investment climate is one where income is being taxed at a slightly higher rate than in 2012. In any taxable account, investors will keep less of their dividend income. You might reinvest the dividends, but you will pay a higher tax on that income. One way to counteract the higher tax rate is to own companies which don't pay dividends, but use their income to buy back their own stock more aggressively. Certainly, we own plenty of companies which already do that. However, if you are faced with higher tax rates on your investment capital, why not invest in startups? A startup might be a situation which takes a long time to become a good business, but if it flourishes you stand to eventually reap the rewards. In the meantime, your capital has to go somewhere and you can choose what areas look promising and leaders you want to take a chance on. So how has it gone so far?

Having contacted a few interesting startups, I must say I think a lot of the founders have a much in common. First, they are enthusiastic about their opportunity. Many are very highly educated with impressive resumes and backgrounds. In most cases, the markets they are targeting are massive. Where the wheels come off the track is the ability to provide or communicate a business plan which shows how the company will grow and attain profitability. Many startups are looking for investors with high-profile networks who can help them reach their goals. Of course they should be discerning about who they get involved with. However, many of these individuals are not realistic about how much their companies are worth. I find venture capitalists and startup founders are completely delusional about the valuations they afford their prospects. At a time where you can find all kinds of situations in the public markets which are very interesting with respect to valuation, to go invest a ton of money on a startup would be giving up potentially great situations in seasoned companies. Perhaps in time the situation may change.

Finally, the debt ceiling negotiations will probably heat up after the inauguration and State of the Union address. It appears as if Republicans will extend the ceiling for 3 months in return for a discussion about how to reform entitlement spending. You wonder if some sense of rationality will ever prevail in Washington?

Maybe the politicians could use some help to find a way to agree?http://www.nytimes.com/2013/01/19/business/negotiation-experts-consider-how-to-reach-a-budget-deal.html?ref=business

The building blocks of our society are in databases-http://techcrunch.com/2013/01/19/your-database-is-probably-terrible/

A nice story on why the future is always bright-http://techcrunch.com/2013/01/18/the-weekly-good-the-problems-of-today-will-be-solved-by-the-minds-of-tomorrow/

Thank you for reading the blog and hopefully I will be more timely in getting my posts up. Have a happy and healthy week!

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

The one area which was interesting was in the investment banking world where Morgan Stanley indicated they are looking forward to concentrating on growth. With the improvement in the housing industry, one would think the large banks focused on consumer credit, mortgage underwriting, and commercial lending would stand to prosper. Shareholders in these companies would certainly welcome better performance as the stocks have been so bad for so long any kind of return to normalized earnings power would boost the entire sector. In fact, they were so beaten down that in 2012 financials were the best performing industry in the stock market.

I just had to bring up the fact that Berkshire Hathaway is rebounding strongly and has had a big move recently. Just to show you how well Mr. Buffett has positioned Berkshire, their ownership of the Burlington Northern railroad was a great investment. Burlington now carries approximately 35% of all the oil in North America which is not moved by pipeline. With a five year backlog on railroad cars, profitability for Burlington is guaranteed for as far as the eye can see. Equity markets reward profits, and about 6 months or a year ago Berkshire's stock was languishing and the critics of Buffett were out in full force. If the energy boom is even remotely as strong as many suggest, it will be a long time before Berkshire Hathaway's stock performs poorly.

I found it interesting that Dell is now discussing a transaction which might take the company private. In the same domain, Hewlett-Packard decided to pay Meg Whitman 14 million dollars for her work last year. My own opinion is the boards of both companies are making big mistakes with these decisions. Dell faces challenges but to go private with a small premium in the hopes of coming back to the public markets in a few years is stupid. As for the board of the largest computer company in the world, maybe they think Meg has stabilized the situation. Still, if you take into consideration the mood of the public for entities like banks which pay executives big compensation packages for poor performance, it is hard to see how this is any different. With the stock at decade lows and questions about how HPQ will compete in tablets and smartphones, as well as being a second tier competitor in enterprise consulting, it would be smart of Mrs. Whitman to reconsider accepting the pay package.

The events in Algeria again point out the importance of energy in the global marketplace. It even further underscores the increased demand of large multi national corporations for security information and services. During this week I read a report on energy trends by a large oil company. The report mentioned the increase in fuel standards (by yes, the Obama Administration) as helping improve efficiency. A few key points were straightforward:

First, there is a massive shift occurring because of the improved capability of producing oil and gas in North America. In 2012, North America produced more energy related resources than ever before, up by about 15% over 2011. Second, emerging countries in Asia are where the vast majority of demand growth in energy will take place. Countries like China and India are going to be dependant on the rest of the world for energy supplies. As much as I hate to admit it, Russia is in a very strong position with respect to energy. The issue there is how effective their companies can be in getting the resources out of ground and to the market. Just as pertinent, the sources of energy production are going to be pretty stable for a long time. Even though the current administration loves to talk about alternative energy investment, the facts indicate materials like oil, natural gas, and coal will remain dominant for a long time. A great deal of the growth in supply will come from alternative energy areas like solar, wind, and nuclear, but they only make up about 7% of total inputs. With energy, the time frames to be considered are decades, not months or years.

Recently, I have been looking into the investment merit of startup companies. My rationale for doing so is the current investment climate is one where income is being taxed at a slightly higher rate than in 2012. In any taxable account, investors will keep less of their dividend income. You might reinvest the dividends, but you will pay a higher tax on that income. One way to counteract the higher tax rate is to own companies which don't pay dividends, but use their income to buy back their own stock more aggressively. Certainly, we own plenty of companies which already do that. However, if you are faced with higher tax rates on your investment capital, why not invest in startups? A startup might be a situation which takes a long time to become a good business, but if it flourishes you stand to eventually reap the rewards. In the meantime, your capital has to go somewhere and you can choose what areas look promising and leaders you want to take a chance on. So how has it gone so far?

Having contacted a few interesting startups, I must say I think a lot of the founders have a much in common. First, they are enthusiastic about their opportunity. Many are very highly educated with impressive resumes and backgrounds. In most cases, the markets they are targeting are massive. Where the wheels come off the track is the ability to provide or communicate a business plan which shows how the company will grow and attain profitability. Many startups are looking for investors with high-profile networks who can help them reach their goals. Of course they should be discerning about who they get involved with. However, many of these individuals are not realistic about how much their companies are worth. I find venture capitalists and startup founders are completely delusional about the valuations they afford their prospects. At a time where you can find all kinds of situations in the public markets which are very interesting with respect to valuation, to go invest a ton of money on a startup would be giving up potentially great situations in seasoned companies. Perhaps in time the situation may change.

Finally, the debt ceiling negotiations will probably heat up after the inauguration and State of the Union address. It appears as if Republicans will extend the ceiling for 3 months in return for a discussion about how to reform entitlement spending. You wonder if some sense of rationality will ever prevail in Washington?

Maybe the politicians could use some help to find a way to agree?http://www.nytimes.com/2013/01/19/business/negotiation-experts-consider-how-to-reach-a-budget-deal.html?ref=business

The building blocks of our society are in databases-http://techcrunch.com/2013/01/19/your-database-is-probably-terrible/

A nice story on why the future is always bright-http://techcrunch.com/2013/01/18/the-weekly-good-the-problems-of-today-will-be-solved-by-the-minds-of-tomorrow/

Thank you for reading the blog and hopefully I will be more timely in getting my posts up. Have a happy and healthy week!

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital

. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Sunday, January 6, 2013

Welcome 2013, Is Change A Comin?, the Fiscal Cliff, and More!

Happy New Year!!! 2013 is upon us and the Mayan calendar was wrong, we made it through 2012 ok. Investors even survived the fiscal cliff, and apparently all is well in the world as the stock market gained 5% last week. I don't think anyone should expect 5% weeks to be normal, but it is consistent with how the market performs. One of the best investors ever, Peter Lynch of Fidelity, always emphasized being fully invested, among other principles like doing a whole lot of homework. Lynch believed you had to be fully invested because history proved that something like 80% of all market gains occur on less than 5 days during the year. If you are trying to time the market by buying and selling, the small number of days when it roars are literally impossible to predict. If you are always fully invested, you participate in full and reap the entire benefits. Certainly, much depends on the individual circumstance and as one gets older, many should not be risking capital they need to live on. Still, the results from last week are important as there may be some big changes occurring in the capital markets.

So what exactly am I referring to? First, last week bond yields rose and the notes the Federal Reserve released showed many members of that board being inclined to start getting hawkish at the first signs of economic growth. Indeed, if the economy starts to perform better and grow quicker, employment and inflation tick up at all, the Federal Reserve will start to walk back their (low) interest rate targets. Now, the caveat is we saw this last January as well, when money poured out of the bond market and into stocks. Money also left gold and went to oil. The important question is will this continue? Earnings reports will start to roll in next week so there is quite a bit to pay attention to in the equity markets.

My two cents on the fiscal cliff deal is it is more evidence of how poor of a job our elected leaders perform. Waiting until the last minute to get deals done is awful for work product and what you get is the result. Essentially, the key issues of spending and entitlement reform were not addressed. Many corporate leaders were very disappointed in the deal. The ex-CEO of Wells Fargo, who ran a very disciplined company when he was in charge, said the country was going to hell and it was a joke that they spent months negotiating to come up with such a poor result. It is more indication we need to have term limits for Congress, not pay for their retirement packages and benefits, and elect better leaders (as President, for example- my editorial comment).

Even worse, it now sets up the end of the February and March as deadlines for a debt limit negotiation between the warring parties again. Pretty much the same bunch arguing about the same issues they have for the last 3 years. For investors, the market focuses on moving from one problem to another. Of course, it is illustrative that long term success in the stock market, like Berkshire Hathaway's recent out performance, is dependant on profits and not political events.

Costco, Sam's Club, or BJ's- I know which one I favor-http://finance.yahoo.com/news/best-warehouse-store-bj-costco-104106736.html

The new Obamacare health care law is not changing the long term trend of health care insurance costs- all they do is keep going up. There are quite a few issues to consider in health care and the following article brings many of them up-http://www.nytimes.com/2013/01/06/business/despite-new-health-law-some-see-sharp-rise-in-premiums.html?pagewanted=2&_r=0&hp

David Rosenberg is a perpetual bear on the stock markets and always talks up bonds, but you need to pay attention to all points of view so here is his 2013 outlook-http://www.businessinsider.com/david-rosenbergs-2013-outlook-2012-12

The idea of traction capital in venture capital is illustrative of the idea to wait until you have proof of concept-http://techcrunch.com/2013/01/06/iterations-traction-capital/

Y H & C Investments, Yale Bock, and the family of Yale Bock own positions in securities mentioned in the blog post. Investing in stocks can lead to the complete loss of your capital. As always, on any company mentioned here, past performance is not a guarantee of future returns. Investing involves risk of losses on invested capital. One should research any investment and make sure it is suitable with your objectives, risk tolerance, risk profile liquidity considerations, tax situation, and anything else pertinent to your financial situation. Also, the CFA credential in no way implies investment returns will be superior for any charter holder.

Subscribe to:

Posts (Atom)